Litecoin Price USD

Litecoin (LTC) has been a significant player in the cryptocurrency market since its inception in 2011. Often dubbed the “silver to Bitcoin’s gold,” Litecoin offers a faster and more cost-effective alternative to Bitcoin, making it a popular choice among investors. However, like all cryptocurrencies, Litecoin’s price is subject to significant volatility, influenced by various factors both within and outside the cryptocurrency market. For new investors looking to understand the intricacies of Litecoin’s price movements, this guide offers an in-depth exploration of the key drivers behind LTC’s price, how to analyze and predict its future trends, and the fundamental aspects that make Litecoin a unique asset in the crypto space.

Understanding Litecoin

Litecoin was created by Charlie Lee, a former Google engineer, as a “lite” version of Bitcoin. It was designed to address some of the perceived limitations of Bitcoin, such as slow transaction times and high fees. Litecoin’s blockchain operates on a similar proof-of-work consensus mechanism but uses a different hashing algorithm called Scrypt, which allows for faster transaction processing and a higher total supply of coins. While Bitcoin is capped at 21 million coins, Litecoin has a maximum supply of 84 million coins. This difference in supply and transaction speed has implications for how Litecoin is used and valued in the market.

Over the years, Litecoin has established itself as a reliable and efficient cryptocurrency, often serving as a testbed for new technologies that are later implemented on the Bitcoin network. For instance, Litecoin was one of the first major cryptocurrencies to adopt Segregated Witness (SegWit) and the Lightning Network, both of which are designed to improve scalability and transaction speed. These technological advancements, coupled with its strong community support, have helped Litecoin maintain its position as one of the top cryptocurrencies by market capitalization.

As of 2024, Litecoin continues to be a popular choice among investors and traders, offering a balance between stability and growth potential. However, understanding what drives the Litecoin price USD is crucial for anyone looking to invest in or trade this cryptocurrency.

Key Drivers of LTC Price Movements

The price of Litecoin, like that of other cryptocurrencies, is influenced by a complex interplay of factors. Understanding these factors is essential for new investors who want to make informed decisions and capitalize on market opportunities. In this section, we will explore the primary drivers behind Litecoin’s price movements, including supply and demand dynamics, external market influences, and investor sentiment.

H3: Supply and Demand Dynamics

Supply and demand are fundamental economic principles that play a crucial role in determining the price of any asset, including cryptocurrencies like Litecoin. The Litecoin price USD is directly impacted by the balance between how much Litecoin is available in the market (supply) and how much investors are willing to pay for it (demand).

One of the key factors influencing Litecoin’s supply is its fixed maximum supply of 84 million coins. Unlike fiat currencies, which can be printed by central banks, the supply of Litecoin is predetermined by its underlying code. This scarcity can create upward pressure on the price as demand increases, especially during periods of heightened interest in cryptocurrencies.

Demand for Litecoin, on the other hand, can be driven by various factors, including its utility as a payment method, its role as a store of value, and its popularity among traders and investors. For instance, when Litecoin is widely accepted by merchants or used in transactions, demand for the cryptocurrency may increase, leading to a rise in price. Additionally, during bull markets, when investor interest in cryptocurrencies is high, demand for Litecoin often surges, contributing to price increases.

However, it is essential to note that supply and demand dynamics are not static. They can change rapidly based on market conditions, technological developments, and external events, all of which can lead to significant price volatility in the short term.

H3: External Market Influences

External factors, such as global economic conditions, regulatory developments, and technological advancements, also play a significant role in shaping Litecoin’s price movements. Understanding these influences is critical for new investors who want to navigate the cryptocurrency market effectively.

Global economic conditions can have a direct impact on the Litecoin price USD. For example, during periods of economic uncertainty or inflation, investors often seek alternative assets to protect their wealth, leading to increased demand for cryptocurrencies like Litecoin. Conversely, during times of economic stability and strong performance in traditional financial markets, demand for cryptocurrencies may decrease, putting downward pressure on their prices.

Regulatory developments are another crucial external factor. Governments and regulatory bodies around the world are still grappling with how to regulate cryptocurrencies, and their decisions can have a profound impact on the market. For instance, positive regulatory news, such as the approval of cryptocurrency exchange-traded funds (ETFs) or favorable tax policies, can boost investor confidence and drive up the price of Litecoin. On the other hand, negative news, such as bans on cryptocurrency trading or stricter regulations, can lead to a decline in prices.

Technological advancements, both within the Litecoin network and in the broader blockchain space, can also influence Litecoin’s price. For example, the implementation of new technologies that improve scalability, security, or transaction speed can make Litecoin more attractive to users and investors, leading to an increase in demand and price. Additionally, the broader adoption of blockchain technology and the integration of cryptocurrencies into mainstream financial systems can create a more favorable environment for Litecoin, supporting long-term price growth.

H3: Investor Sentiment and Market Psychology

Investor sentiment and market psychology are often overlooked but are powerful drivers of cryptocurrency prices. Unlike traditional financial markets, where prices are often influenced by fundamental factors such as earnings reports and economic data, the cryptocurrency market is heavily influenced by the emotions and perceptions of investors.

Investor sentiment refers to the overall attitude of investors towards a particular asset, which can range from extreme optimism to extreme pessimism. In the case of Litecoin, positive sentiment can drive up the Litecoin price USD, while negative sentiment can lead to a decline. For instance, during periods of positive news or bullish market conditions, investors may become more optimistic about Litecoin’s future, leading to increased buying activity and higher prices. Conversely, during periods of negative news or bearish market conditions, sentiment can turn negative, leading to selling pressure and lower prices.

Market psychology, which encompasses the collective behavior and decision-making patterns of investors, also plays a significant role in price movements. In the cryptocurrency market, where prices can change rapidly, herd behavior—where investors follow the actions of others—can amplify price movements. For example, during a bull market, as more investors buy into Litecoin, prices may rise rapidly, creating a feedback loop that drives even more buying. Conversely, during a bear market, fear and panic can lead to widespread selling, causing prices to drop quickly.

For new investors, understanding the role of investor sentiment and market psychology is essential for navigating the volatile cryptocurrency market. By staying informed about market developments and recognizing the emotional factors that influence price movements, investors can make more rational decisions and avoid common pitfalls such as panic selling or buying into a bubble.

Analyzing and Predicting LTC Price

Predicting the future price of Litecoin is a challenging task, given the many variables that can influence its value. However, by using various analytical tools and techniques, investors can gain insights into potential price movements and make more informed decisions. In this section, we will explore the basics of technical analysis, the importance of market indicators, and how to develop a Litecoin price prediction.

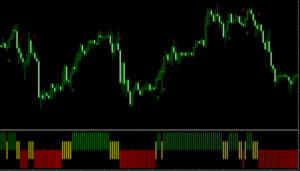

H3: Technical Analysis Basics

Technical analysis is a method used by traders and investors to analyze price charts and identify patterns that can indicate future price movements. Unlike fundamental analysis, which focuses on the underlying value of an asset, technical analysis is based on the premise that historical price data can provide insights into future price trends.

For Litecoin, technical analysis involves examining price charts, volume data, and other technical indicators to identify patterns and trends. Some of the most commonly used technical analysis tools include moving averages, relative strength index (RSI), and Fibonacci retracement levels.

Moving averages, which smooth out price data to create a trend line, are often used to identify the overall direction of the market. For example, when the price of Litecoin is above its moving average, it may indicate an upward trend, while a price below the moving average may suggest a downward trend.

The relative strength index (RSI) is another popular tool that measures the speed and change of price movements. It is often used to identify overbought or oversold conditions in the market. For instance, when the RSI is above 70, it may indicate that Litecoin is overbought and could be due for a price correction. Conversely, an RSI below 30 may suggest that Litecoin is oversold and could be poised for a price rebound.

Fibonacci retracement levels, which are based on the Fibonacci sequence, are used to identify potential support and resistance levels. These levels can help traders determine entry and exit points for their trades, as well as anticipate potential price reversals.

While technical analysis can provide valuable insights into Litecoin’s price movements, it is essential to remember that it is not a foolproof method. The cryptocurrency market is highly volatile, and prices can be influenced by factors that are not always reflected in historical data. Therefore, technical analysis should be used in conjunction with other analytical tools and a comprehensive understanding of the market.

H3: Understanding Market Indicators

Market indicators are another essential tool for analyzing and predicting Litecoin’s price movements. These indicators provide insights into the broader market conditions and can help investors anticipate potential price trends.

One of the most widely used market indicators is trading volume, which measures the number of Litecoin transactions over a specific period. High trading volume often indicates strong market interest and can signal the strength of a price trend. For example, during a price rally, increasing trading volume may suggest that the trend is likely to continue. Conversely, declining volume during a price rally may indicate that the trend is losing momentum and could be due for a reversal.

Another important market indicator is the order book, which displays the current buy and sell orders for Litecoin on an exchange. By analyzing the order book, investors can gain insights into the supply and demand dynamics at different price levels. For example, a large number of buy orders at a specific price level may indicate strong support, while a large number of sell orders may suggest resistance.

Sentiment indicators, which measure the overall mood of the market, are also valuable tools for predicting price movements. These indicators can be derived from various sources, including social media activity, news sentiment, and surveys of investor sentiment. For instance, a high level of positive sentiment on social media platforms like Twitter or Reddit may indicate increased interest in Litecoin, which could lead to higher prices. Conversely, negative sentiment may signal potential price declines.

By combining technical analysis with market indicators, investors can develop a more comprehensive view of Litecoin’s price movements and make more informed decisions. However, it is important to remember that market indicators are not always accurate predictors of future price trends and should be used in conjunction with other forms of analysis.

H3: Predicting Future Price Trends

While predicting the future price of Litecoin is inherently challenging, it is possible to develop a Litecoin price prediction by analyzing various factors and trends. In this section, we will explore some of the key considerations for predicting Litecoin’s future price, including market cycles, technological developments, and external influences.

Market cycles, which refer to the recurring phases of bull and bear markets, are a crucial factor in predicting future price trends. In the cryptocurrency market, these cycles are often driven by investor sentiment and external events, such as regulatory developments or technological advancements. For instance, during a bull market, positive sentiment and increased demand for cryptocurrencies can drive prices higher, while during a bear market, negative sentiment and reduced demand can lead to price declines.

Technological developments are another important consideration for predicting Litecoin’s future price. As mentioned earlier, Litecoin’s focus on scalability, transaction speed, and security has made it a popular choice among users and investors. Future upgrades to the Litecoin network, such as the implementation of new privacy features or improvements to scalability, could enhance its utility and drive up demand, leading to higher prices.

External influences, such as global economic conditions and regulatory developments, also play a significant role in shaping Litecoin’s future price trends. For example, if cryptocurrencies become more widely accepted as a legitimate asset class, and regulatory frameworks become more favorable, it could lead to increased adoption and higher prices for Litecoin. Conversely, negative regulatory developments or economic instability could lead to reduced demand and lower prices.

While it is impossible to predict the future with certainty, by analyzing these factors and staying informed about market developments, investors can develop a more informed view of Litecoin’s potential price trends. However, it is important to remember that the cryptocurrency market is highly volatile, and prices can change rapidly based on a wide range of factors. Therefore, investors should approach price predictions with caution and consider them as part of a broader investment strategy.

Conclusion

Litecoin is a significant player in the cryptocurrency market, offering a unique combination of speed, efficiency, and security. However, like all cryptocurrencies, its price is subject to significant volatility, influenced by various factors.